The Ultimate Guide To Matthew J. Previte Cpa Pc

The Ultimate Guide To Matthew J. Previte Cpa Pc

Blog Article

Matthew J. Previte Cpa Pc Can Be Fun For Everyone

Table of ContentsThe 8-Minute Rule for Matthew J. Previte Cpa PcGet This Report on Matthew J. Previte Cpa PcA Biased View of Matthew J. Previte Cpa PcThe Best Guide To Matthew J. Previte Cpa PcThe smart Trick of Matthew J. Previte Cpa Pc That Nobody is Talking About10 Simple Techniques For Matthew J. Previte Cpa Pc

Tax obligation legislations and codes, whether at the state or federal degree, are also made complex for many laypeople and they transform also typically for numerous tax obligation specialists to stay up to date with. Whether you simply need someone to assist you with your service revenue taxes or you have actually been billed with tax obligation scams, work with a tax obligation lawyer to help you out.

The Best Guide To Matthew J. Previte Cpa Pc

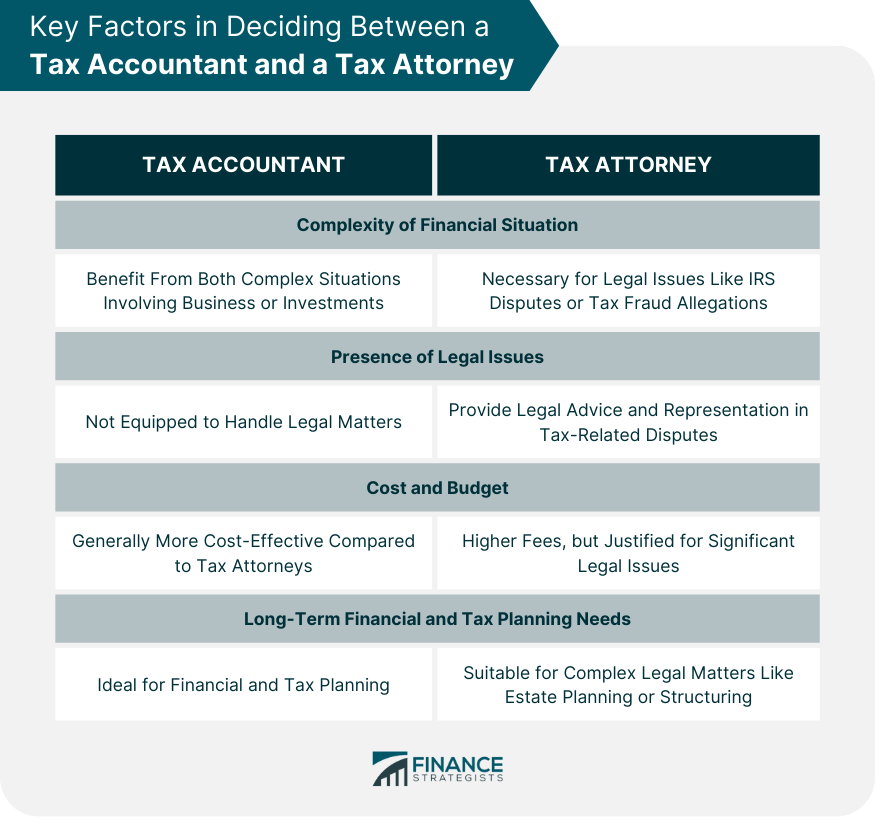

Everybody else not only disapproval handling taxes, however they can be outright scared of the tax obligation companies, not without factor. There are a couple of questions that are always on the minds of those who are managing tax obligation problems, including whether to employ a tax attorney or a CPA, when to employ a tax obligation attorney, and We wish to assist answer those concerns here, so you understand what to do if you find yourself in a "taxing" circumstance.

An attorney can stand for clients before the IRS for audits, collections and allures but so can a CERTIFIED PUBLIC ACCOUNTANT. The big difference right here and one you need to remember is that a tax obligation legal representative can supply attorney-client advantage, implying your tax lawyer is exempt from being urged to testify versus you in a law court.

Rumored Buzz on Matthew J. Previte Cpa Pc

Or else, a CPA can testify versus you even while helping you. Tax obligation lawyers are much more accustomed to the various tax obligation settlement programs than many Certified public accountants and understand how to choose the most effective program for your situation and exactly how to obtain you gotten approved for that program. If you are having a problem with the internal revenue service or just inquiries and issues, you need to employ a tax lawyer.

Tax obligation Court Are under examination for tax fraudulence or tax obligation evasion Are under criminal investigation by the IRS One more important time to employ a tax attorney is when you obtain an audit notification from the IRS - IRS Collection Appeals in Framingham, Massachusetts. https://www.figma.com/file/2rTOrt6ye8rCQIYmg5Aga3/Untitled?type=design&node-id=0%3A1&mode=design&t=HCXHANXo9rpZJxMM-1. An attorney can interact with the internal revenue service on your behalf, exist throughout audits, help bargain settlements, and maintain you from paying too much as an outcome of the audit

Component of a tax obligation lawyer's duty is to stay on top of it, so you are safeguarded. Your ideal resource is word of mouth. Ask about for a skilled tax attorney and check the web for client/customer reviews. When you interview your choice, ask for extra recommendations, specifically from clients who had the very same problem as yours.

Facts About Matthew J. Previte Cpa Pc Uncovered

The tax obligation lawyer you have in mind has all of the appropriate credentials and testimonies. Should you hire this tax obligation attorney?

The choice to hire an IRS attorney is one that ought to not be taken lightly. Lawyers can be incredibly cost-prohibitive and make complex matters unnecessarily when they can be dealt with fairly easily. In basic, I am a huge supporter of self-help lawful services, specifically given the selection of educational material that can be discovered online (consisting of much of what I have actually published on the topic of tax).

Indicators on Matthew J. Previte Cpa Pc You Need To Know

Right here is a quick checklist of the matters that I believe that an internal revenue service lawyer should be hired for. Let us be completely honest for a second. Criminal fees and criminal investigations can ruin lives and bring really severe consequences. Anybody who has invested time in prison can fill you in on the facts of prison life, but criminal charges often have a far more revengeful result that many individuals fall short to take into consideration.

Lawbreaker fees can additionally bring additional civil penalties (well beyond what is common for civil tax matters). These are just some examples of the damages that even just a criminal fee can bring (whether an effective sentence is eventually acquired). My point is that when anything possibly criminal develops, also if you are just a prospective witness to the matter, you require a seasoned IRS attorney to represent your passions against the prosecuting agency.

This is one instance where you constantly require an IRS attorney watching your back. There are many parts of an Internal revenue service lawyer's work that are apparently regular.

A Biased View of Matthew J. Previte Cpa Pc

Where we make our stripes however gets on technical tax matters, which put our complete ability to the examination. What is a technological tax obligation concern? That is a challenging concern to respond to, however the very best means I would certainly explain it are matters that call for the professional judgment of an IRS lawyer to deal with effectively.

Anything that has this "reality dependency" as I would call it, you are mosting likely to desire to generate an attorney to seek advice from with - tax attorney in Framingham, Massachusetts. Also if you do see this here not maintain the services of that lawyer, a professional perspective when managing technological tax obligation matters can go a long method towards recognizing issues and settling them in a proper manner

Report this page